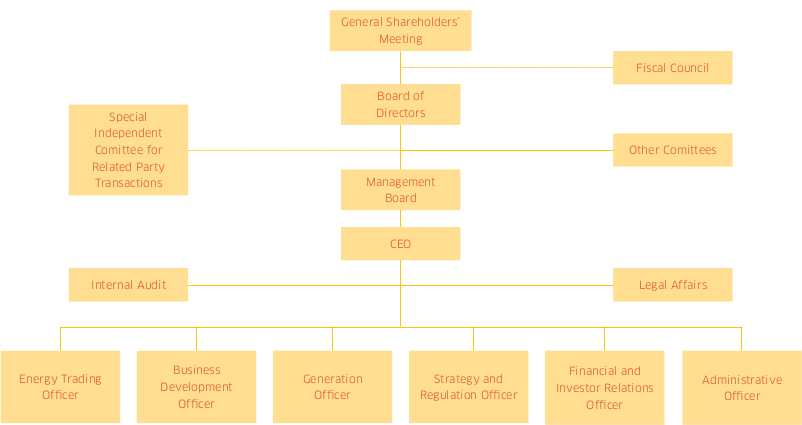

ENGIE Brasil Energia’s operations are aligned to the best market practices of corporate governance including the requirements of the Sarbanes-Oxley Act. The Company conducts its businesses based on ethics and integrity, committed to guaranteeing the rights of the shareholders and transparency of its actions.

The Company is part of BM&FBovespa’s Novo Mercado, a segment destined for the trading of shares of companies, which voluntarily adopt corporate governance practices additional to those required by the Brazilian legislation. A listing in this segment requires the adoption of corporate rules, which enhance investors’ rights, as well as a comprehensive policy for disclosing information to the market.

With the purpose of protecting the interests of all shareholders, ENGIE Brasil Energia guarantees them the following rights:

Voting in General Meetings, both annual and extraordinary.

Submitting recommendations to the Board of Directors through a specific channel in the website’s Investors Portal.

Receiving dividends and participating in the distribution of earnings or other distributions.

Supervising management's activities and withdrawing from the Company should specific situations enshrined in the Joint Stock Company Law arise.

Receiving at least 100% of the price paid per common share of the controlling bloc in the event of a public offering of shares as a result of the sale of a controlling stake (100% tag along) in accordance with Novo Mercado listing regulations.

ENGIE Brasil Energia’s corporate bylaws establish that any dispute between shareholders especially related to the capital markets and to corporate law must be settled through the independent and confidential Market Arbitration Panel – a body under the auspices of the BM&FBovespa - for the solution of disagreements.

These and other guidelines on the relationship established between ENGIE Brasil Energia and its shareholders may be consulted in the Company’s Bylaws, available from its website (www.engieenergia.com.br).

The Company is part of BM&FBovespa’s Novo Mercado, a segment destined for the trading of shares of companies, which voluntarily adopt corporate governance practices additional to those required by the Brazilian legislation.