Economic performance

Positive results

America Latina Logística rail operations ended 2013 with net revenues of R$ 3.1 billion, an increase of 8.9% compared with 2012. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) grew by 8.1%, reaching R$ 1.75 billion. Net profit, at R$ 277.2 million, increased by 1.3%, excluding the effects of the termination of the concession operated by the company in Argentina. Consolidated net revenues for the Grupo ALL were R$ 3.6 billion in 2013, with an 8.4 p.p. increase in EBITDA compared with 2012.

In spite of the positive financial results, 2013 was a difficult year in operational terms. Diverse business restrictions in the ports in which ALL operates led to a 1.2% reduction in freight volume, which was 44.7 billion TKU. In the grain segment, two accidents in the main rail discharge terminals – the TGG (Guarujá Grain Terminal) and Terminal 39 (right bank) – limited the operation during the harvest transportation period. These accidents forced the company to channel rail operations to smaller, less efficient terminals, reducing average productivity for railcars and locomotives, especially during the second and third quarters of the year. Furthermore, a fire completely destroyed the sugar terminal in the Port of Santos in October, and excessive rainfall during part of the winter restricted the unloading capacity of the terminals in the ports of Santos and Paranaguá, directly impacting railway productivity.

The rail accident in November in São José do Rio Preto (São Paulo) (read more in Operational safety) closed the most important corridor operated by the company for a period of almost nine days, also affecting ALL productivity. Operations on the line were interrupted, with long lines of trains forced to wait for the resumption of services. Operations on the line were eventually reestablished on a provisional basis with a broad support mechanism, but productivity and freight capacity were still restricted throughout the month December.

The accident and the restrictions on port operations reduced freight volume in the third quarter (3.8% down on the same quarter in 2012) and caused a 5.1% increase in diesel consumption in 2013.

Total ALL investments in 2013 were R$ 742.7 million, a 6.7% reduction compared with 2012, due to the fact that work on the Rondonópolis Intermodal Terminal was concluded at the end of 2012.

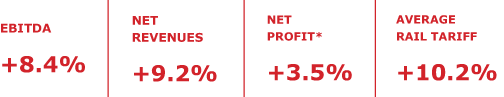

Variation in main financial indicators (2012 x 2013)*

* Excluding the effects of the termination of operations in Argentina.

| Generation of added value (R$ million) | 2013 |

|---|---|

| 1. Gross revenues | 4.303,1 |

| 2. Inputs acquired from third-parties | 1.385,5 |

| 3. Gross added value (1 - 2) | 2.917,5 |

| 4. Depreciation and amortization | 526,6 |

| 5. Net added value (3 - 4) | 2.390,9 |

| 6. Added value received in transfer | 84,2 |

| 7. Added value for distribution (5 + 6) | 2.475,1 |

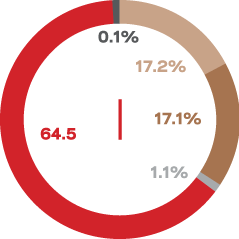

| Distribution of added value | 2013 |

| Shareholders | 0,1% |

| Employees (remuneration, benefits and charges) | 17,2% |

| Government (taxes, charges and contributions) | 17,1% |

| Retained profit/loss | 1,1% |

| Interest and rents (remuneration of third-party capital) | 64,5% |

Targeted growth

Productivity gains, a focus on results and new investments are the foundations of the company's growth strategy, based on five principles:

Concentrate growth where ALL has a clear competitive advantage. The company plans to serve specific markets and rail/intermodal corridors to increase its market share among traditional rail service customers. It also wants to invest in customers producing industrial goods for whom intermodal services represent a more efficient means of freight than road transport.

Maintain rigid cost controls. Cost discipline needs to be reconciled with volume and revenue growth. The main initiatives include control over fuel consumption and the identification of alternative suppliers of oil derivatives.

Honor commitments to customers. ALL acknowledges that this is one of the bases for its growth and the trust customers place in the operation. In line with this principle, the company has developed partnerships with customers, a broad-based logistics infrastructure around the rail network and has been signing long-term contracts for the provision of railcars to customers.

Maximize asset utilization and return on capital. To increase profitability, ALL focuses investments on eliminating bottlenecks, seeking to align equipment acquisitions with expected demand.

Strategic investments, alliances and acquisitions. The goal is to expand the rail network's potential whenever the company identifies an opportunity to boost efficiency, create operational synergies or expand its potential market.

Argentina

In June 2013, the Argentinean government rescinded ALL’s concessions in the country. ALL had been planning to discontinue its operations in Argentina since 2012 – due to the local political and economic situation – and was already in advanced negotiations with a local group interested in taking over the business.

The company acquired the Argentinean rail network in 1999. At the time, ALL expected it would be able to improve assets and achieve productivity gains (as happened in Brazil) to drive operational growth in the country, which is also a large agricultural commodity producer and has a favorable geography for rail transportation.

Over time, however, the political and economic situation in Argentina limited the profitability of the operation, diminishing its importance in the group's overall business. The Argentinean government adopted measures which generated a significant financial imbalance in the concessions. These included obliging the company to transport passengers, an activity outside ALL's operational scope. Furthermore, labor-related issues led to significant increases in operating costs. In 2012, the Argentinean concessions accounted for 6.5% of the Grupo ALL's net revenues.