Who we are

In addition to railway operations, All works with container logistics; road transportation; and the extraction, logistics and commercialization of iron ore.

ALL Railway Operations

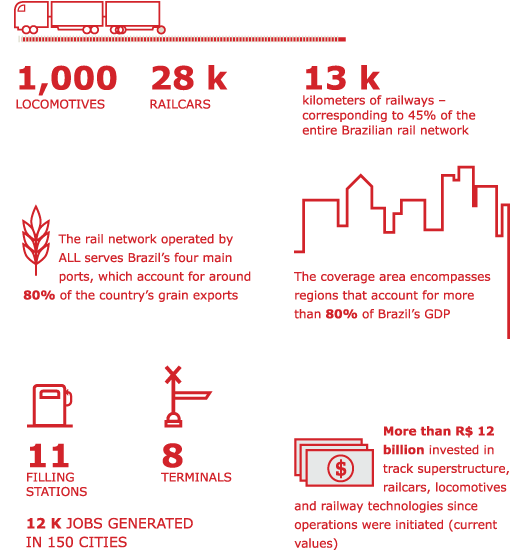

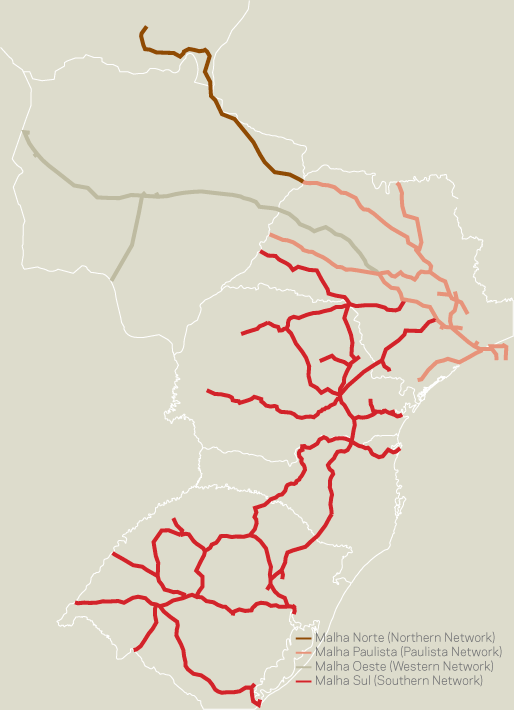

ALL Operações Ferroviárias (ALL Railway Operations) is part of the America Latina Logística S.A. holding company, the largest independent logistics operation in Latin America. Founded in 1997 to operate the country's Malha Sul (Southern Network) concession granted by the Rede Ferroviária Federal (RFFSA), the company has been expanding its activities in the Brazilian national logistics sector. Currently, its operation connects regions accounting for more than 80% of Brazil's GDP and four ports responsible for the major part of Brazilian grain exports.

From its head office in Curitiba (Paraná), the company operates four concessions: the ALL Southern, Western, Paulista and Northern networks (ALL Malha Sul S.A., ALL Malha Oeste S.A., ALL Malha Paulista S.A. and ALL Malha Norte S.A.). These total approximately 13 thousand km of railways, or 45% of the rail network in Brazil. The structure also comprises 12 production units with railcar and locomotive maintenance depots and filling stations in six states – Paraná, Rio Grande do Sul, Santa Catarina, Sao Paulo, Mato Grosso and Mato Grosso do Sul. The main products the company transports include agricultural commodities (such as corn, soy, soy meal and sugar) and industrial products. The latter market breaks down into two segments:

- Typical railroad products: fuels, vegetable oils and civil construction materials. These types of cargo have traditionally been transported by rail in Brazil, even before the privatization process. ALL's large share in this segment means that the company's results closely linked with market performance.

- Intermodal products: these include cargos that do not have a tradition in rail freight in Brazil, but have started using this means of transport in function of the operational improvements undertaken in recent years. They include: timber, pulp and paper, steel products, foods and containers.

At the end of 2013, ALL operated a fleet of around one thousand locomotives and 28 thousand railcars, generating 12 thousand jobs in 150 cities in Brazil. To ensure that employees' professional development is on a par with the quality services and high technology the company provides, ALL trains its work force via its own corporate university, UniALL. Since UniALL was created in 2010, more than 15 thousand employees have undergone training in the institution.

The main changes in company structure in 2013 included the termination of operations in Argentina (read more in Economic performance).

In addition to its rail operations, ALL operates on three other business fronts: Brado Logística, which is active in the container market; Ritmo Logística, a company dedicated to road transportation; and Vetria Mineração, a project aimed at developing an integrated solution for the extraction, logistics and commercialization of iron ore from the Corumbá region (Mato Grosso do Sul) via the Port of Santos. Jointly, the Grupo ALL operations generated net revenues of R$ 3.6 billion in 2013, an increase of 9.2% compared with 2012 (read more in New businesses).

Awards and recognitions

- CartaCapital magazine award: Most Admired Company in the Logistics Segment in Brazil

- Exame Biggest and Best Award: Best Company in the Rail Freight Segment

- Consumidor Moderno Award for Excellence in Customer Service: Best Company in the Logistics Category

- Top Employers Award: recognition for human resources management and career development performance

- Chico Mendes Socio-Environmental Responsibility Award, granted by the Instituto Chico Mendes

- IR Global Rankings: ALL was recognized in the Online Annual Report and Disclosure of Financial Information categories

The ALL railroads in Brazil

Our operations

Evolution: from privatization to the present moment

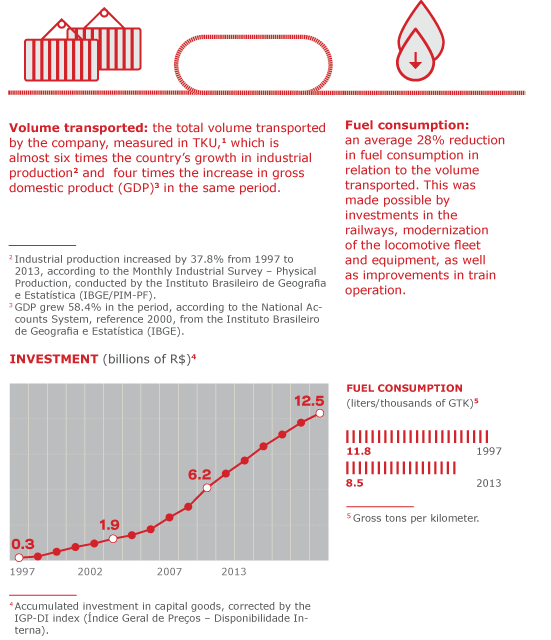

Since it initiated operations, ALL has invested R$ 12.5 billion in improvements. In total, the funds ALL has invested in the Southern, Western and Paulista networks have exceeded the amount projected by the BNDES (Banco Nacional de Desenvolvimento Econômico e Social) in 1997 in the estimates which served as a guide for the auction of the networks.

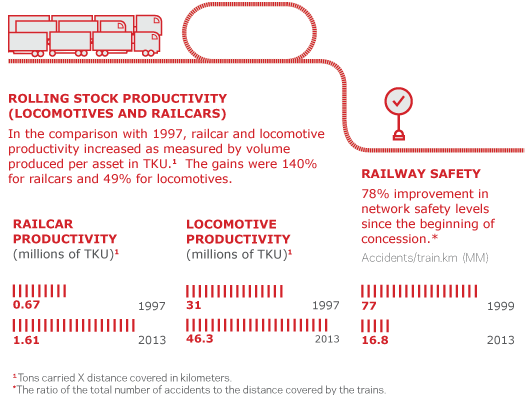

Investments have been directed at fleet expansion, increased productivity and railway safety. The main results for recent years are shown below.

New businesses

Brado Logística

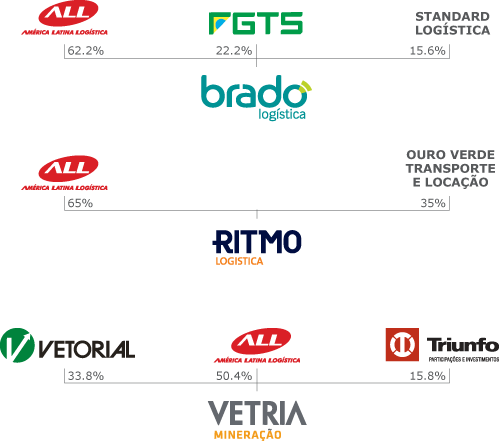

Founded in December 2010, Brado is the result of an association between ALL – which has a 62.22% stake – and Standard Logística and the FGTS Investment Fund (FI-FGTS). It is the first Brazilian company fully dedicated to providing intermodal container logistics services centered on rail transportation, warehousing and terminal operations. Aimed at the retail sector, Brado offers a new container logistics model: it consolidates cargo in intermodal terminals and transports it by rail, reducing costs and meeting the specific needs of each customer. The main competitive advantages the business offers are:

- Long distance rail transportation: this integrates the flexibility of road transport with the lower cost of rail transport, providing a differential for customers. The model is guaranteed by investments in intermodal terminals in the interior of the country and the expansion of ALL rail capacity.

- Services and warehousing in the country's interior: Brado offers an alternative to storing containers in ports, where space is scarcer and more expensive. The company’s services include multi-temperature controlled storage (frozen, cold, acclimatized and dry), container loading and unloading and administrative management.

- Greater productivity in container use: with its base of terminals in the interior, Brado ensures greater efficiency in container logistics. Closer to production regions than the ports, the Brado terminals receive and dispatch containers in both directions, boosting container productivity.

Brado operations are divided between the four regions in which the company operates: connecting Mato Grosso and São Paulo with the Port of Santos; Mercosur (connecting São Paulo with the south of the country and Argentina by means of an intermodal terminal in Uruguaiana – Rio Grande do Sul); Paraná (from the interior of this state to the ports of Paranaguá and São Francisco do Sul); and Rio Grande (connecting producer regions in Rio Grande do Sul with the Port of Rio Grande).

Although still small in Brazil, the container rail transportation market shows great potential. Brado estimates market potential in the regions in which it operates at more than 2.6 million containers per year.

In 2013, the freight transported by the company – measured by the number of containers transported – grew 23.7% compared with the previous year. The company’s net revenues increased 18.8% in the year, reaching R$ 276.3 million. EBITDA was R$ 55 million, up 30.8% compared with the previous year. These results were made possible by the increase in the number of locomotives and railcars in operation in 2013 as a means of sustaining company growth.

In the third quarter of 2013, Brado received R$ 400 million in capital from the FGTS Investment Fund (FI-FGTS). As a result of this capitalization, ALL’s stake in Brado was reduced from 80% to 62.2%. These funds are being invested principally in transportation infrastructure and intermodal assets, such as rolling stock, terminals and track superstructure, and are aligned with the company’s plan to invest R$ 1 billion in the first five years of the operation.

Ritmo Logística

The company provides road freight services from two business units: the Intermodal Unit and the Dedicated Services Unit. The strategy for the Intermodal Unit is to operate on highways linking factories, ports and warehouses to the rail transshipment terminals, serving a market with an estimated annual volume of over 40 million metric tons.

Controlled by ALL Logística, which has a 65% stake in the company, Ritmo was founded in July 2011 based on the merger of ALL’s Road Services unit with the road operations of Ouro Verde Transporte e Locação.

The Dedicated Services Unit provides customized services for three market segments: the automotive sector (parts transport); the general cargo segment (pulp and paper, chemical products and consumer goods); and specialized assets (such as industrial gases, beverages and industrial glass). The Intermodal Unit works mainly with agricultural products and with other customers whose products either originate in or are bound for the regions in which ALL railways operate.

In 2013, the volume transported by Ritmo increased by 5.7%, driven by Intermodal Unit business. The company’s EBITDA dropped by 4.1% in the year, mainly due to tariff reductions and poor performance in the last quarter of the year.

Vetria Mineração

Vetria was created based on a partnership between ALL S.A. – which as a 50.4% stake in the company –, Triunfo and Vetorial Mineração. Some research is still pending before operations may begin. The company is developing an integrated solution for the extraction, logistics and commercialization of iron ore from Maciço de Urucum, close to Corumbá in the state of Mato Grosso do Sul. Production potential in the area is very significant, but logistics conditions are deficient. Vetria will have an integrated system comprising its own mine in Corumbá, rail logistics via a long-term operational contract with ALL Rail Operations and a private port terminal in Santos (São Paulo) to export the mineral.

The company projects an annual production and export capacity of 27.5 million metric tons of high grade iron ore. Projected investments to make the venture operational total around R$ 11.5 billion, including the expansion of the mine, the recuperation and expansion of rail capacity and the construction of the port terminal in Santos (São Paulo). These works will depend on raising funds in the financial market or via a strategic partner, without any guarantees or financial obligations on the part of ALL shareholders.

In 2013, the Vetria integrated mining, port and railway project progressed. The first stage in the certification of the mine was concluded in the first quarter of the year, with estimated reserves of around 10 billion metric tons of ore having an average iron content of 46%, compared with an initial estimate of 1 billion.

Furthermore, during the year two essential conditions for the realization of the project were achieved: in February, the antitrust authority Cade (Conselho de Defesa Nacional) authorized the transfer of the mining rights from Vetorial Mineração S.A. to Vetria and, in November, the environmental authority Ibama (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais) issued the preliminary environmental license for the area Vetria has in the Port of Santos. The company is currently engaged in the process of obtaining an installation license from Ibama for the construction and exploitation of its private port installation. This is expected to be granted in 2014.

For further information about this operation, access www.vetria.com.br.

Main events in 2013

ALL Railway Operations

Economic results

Although there were diverse restrictions in the ports in which All Railway Operations operates, the balance in the company’s main economic-financial indicators for 2013 was positive. ALL Railway Operations’ net revenues grew 8.9% compared with 2012. In the same period, EBITDA increased by 8.1% and net profit by 1.3%.* In the ALL Group consolidated results, net revenues were R$ 3.6 billion, an increase of 9.2% over 2012. EBITDA grew by 8.4% and net profit by 3.5%.* (read more on Argentina).

* Excluding the effects of the termination of operations in Argentina.

Duplication of the Paulista Network (Campinas-Santos railway)

Throughout 2013, ALL maintained focus on driving the duplication of the Campinas-Santos line (part of the Paulista Network). In March 2014, the environmental authority Ibama (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais) issued a license for the execution of works on the stretches Embu-Guaçu to Evangelista de Souza and Paratinga to Perequê. Duplication is a priority in the company’s strategic planning. Once concluded, this work will expand the structural capacity of the main export corridor for agricultural commodities in the country – which accounts for around 60% of the company's total freight volume. This corridor connects the states of Mato Grosso and São Paulo with the Port of Santos, contributing significantly to making the overall Brazilian logistics network more competitive. The investment will enable ALL to increase productivity on what is currently its densest rail route and more than double freight capacity on the duplicated stretch. The works on the sub-stretches Embu-Guaçu to Evangelista de Souza and Paratinga to Perequê, for which licenses were still pending before March 2014, are now underway and should be concluded in the first quarter of 2015 (read more on Duplication of the Paulista Network).

Beginning of operations in the Rondonópolis Complex

Using own funding totaling R$ 880 million, in September 2013 ALL inaugurated the largest intermodal complex in Latin America. One of the most important rail ventures undertaken by a private company in the country, the project brings rail transportation close to Brazil’s agricultural frontier, boosting capacity to transport agricultural products from the Midwest region to the Port of Santos along the country’s main grain export corridor. Initiated in 2009, the project comprises an intermodal complex and a 260-kilometer extension to the Northern Network in direction of the agricultural production region in the state of Mato Grosso (read more on Rondonópolis Intermodal Complex).

Customer relations

Worthy of note was the project undertaken in partnership with Eldorado Brasil involving the outbound logistics for the company’s pulp plant in Três Lagoas (Mato Grosso do Sul). The plant reached full production capacity at the end of 2013, and the annual pulp volume to be transported is projected at around 800 thousand metric tons. The project consumed investments of some R$ 300 million in rolling stock, track infrastructure improvements and the construction of transshipment terminals in Aparecida do Taboado (Mato Grosso do Sul) and Santos (São Paulo) (read more on Eldorado Project).

Signature of contract with BNDES

In May 2013, ALL obtained lines of credit from the foment bank BNDES (Banco Nacional de Desenvolvimento Econômico e Social). The credit lines total R$ 1.7 billion, at a cost of Brazil's TJLP rate (long-term interest rate) + 1.4% per year. This is payable over eight years with a one-year grace period and will finance investments for the period between 2013 and 2015.

These credit lines will be used to finance 80% of the company’s investments in its rail operations, including track superstructure, rolling stock (locomotives and railcars), information technology, operational technology, terminals, as well as social investments in the railways' areas of influence.

Termination of operations in Argentina

On July 5th, 2013, the Argentinean government rescinded ALL’s concessions in the country. ALL had already informed the market that it was planning to discontinue its operations in the country in function of the local political and economic situation. Over the years, ALL Argentina has contributed little to the company’s consolidated results, requiring a disproportionate amount of management attention. (read more on Argentina).

ALL and Rumo: proposed merger

On February 24th, 2014, ALL received a proposal from Rumo Logística Operadora Multimodal S.A. involving the merger of its activities with ALL’s through the incorporation of ALL stock by Rumo. With this incorporation, ALL shareholders will detain 63.5% of the new company's stock, while Rumo shareholders will have a 36.5% holding. The shareholders of both companies approved the proposal on May 8th, 2014. The merger is still subject to the approval of the Brazilian antitrust authority Cade (Conselho Administrativo de Defesa Econômica) and the national ground transport agency ANTT (Agência Nacional de Transportes Terrestres). The merger between ALL and Rumo, which is currently an ALL customer, will result in important synergies for the new company in the form of productivity gains through the integration of rail and port activities, asset availability and the potential to operate with more profitable cargoes (read more on ALL and Rumo: proposed merger).

New businesses

Advances with Vetria

Vetria progressed in the development of its integrated mining, rail and port project. The first phase of the certification of the mine was concluded in the first quarter of the year, resulting in the revision of the estimated reserves in the mine from 1 billion to 10 billion metric tons, with an average iron content of 46%. In parallel, the company obtained a preliminary environmental license from the environmental authority Ibama (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais) for a private terminal with a static capacity of 2 million metric tons to handle the iron ore produced by Vetria. This represents an important step towards the realization of the project.

Capitalization of Brado

The capitalization of Brado was approved officially and without restrictions by the antitrust authority Cade (Conselho Administrativo de Defesa Econômica) in July 2013. This was the last step towards concluding the agreement and receiving R$ 400 million in capital from the FGTS Investment Fund (FI-FGTS). With this capitalization, ALL’s stake in the company decreased from 80% to 62.2%. Brado Logística is involved in intermodal container logistics, focused on rail transportation, warehousing, terminal operation and other logistics services.