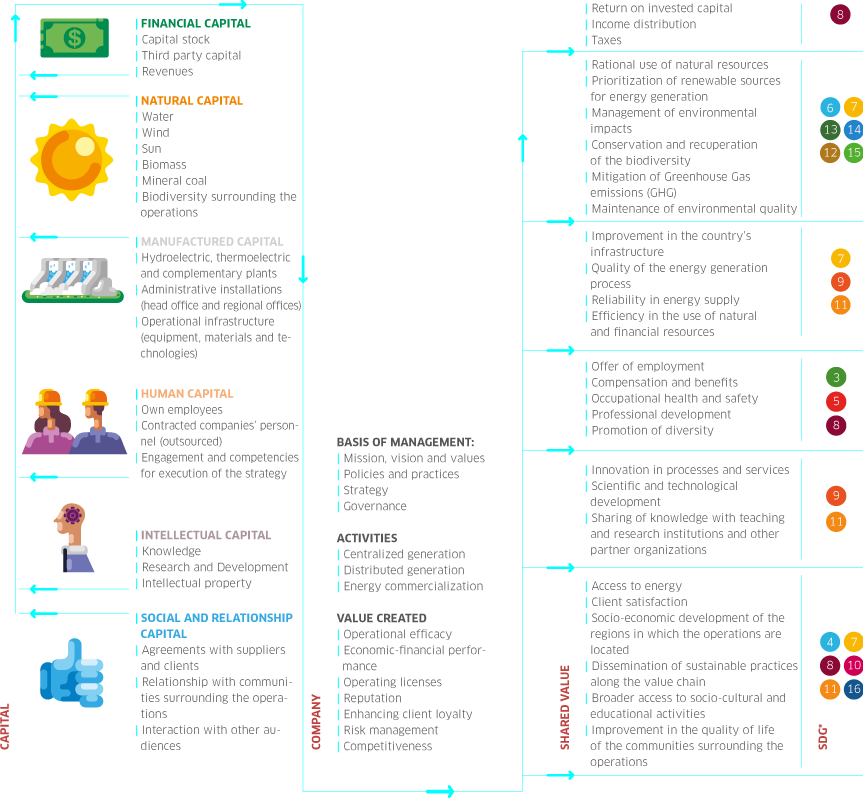

ENGIE Brasil Energia’s business model focuses on sustainability, its intention being to respond dynamically to the challenges and opportunities in the energy sector on both global and domestic levels. Starting from an understanding that the current transformations which the sector is undergoing are natural and necessary to the evolution of society, the Company shares the same objective as that proposed by ENGIE, its parent company to all its business units: to be in the vanguard of the energy transition worldwide.

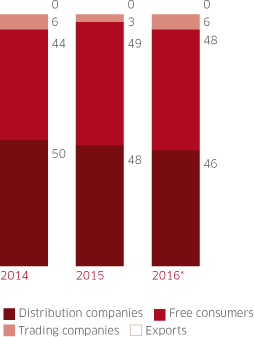

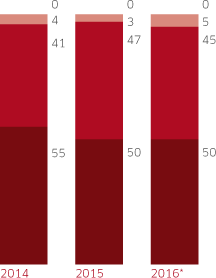

Consequently, ENGIE Brasil Energia’s business model is aligned with the tendencies of decarbonization, decentralization and digitization, which are characterizing the future of the sector. This transition requires a broadening of the vision of the business in order to ensure the creation of value over the medium and long terms. Thus, the key operational areas of ENGIE Brasil Energia continue to be centralized generation, prioritizing renewable sources, and the commercialization of energy although at the same time, seeking increasingly to offer integrated and innovative solutions. In 2016, an important step in this direction was the Company’s debut into the distributed solar energy generation segment through the ENGIE Geração Solar Distribuída subsidiary. GRI G4-8; G4-EC2

The key operational areas of ENGIE Brasil Energia continue to be centralized generation, prioritizing renewable sources, and the commercialization of energy although at the same time, seeking increasingly to offer integrated and innovative solutions.