ENGIE Brasil Energia

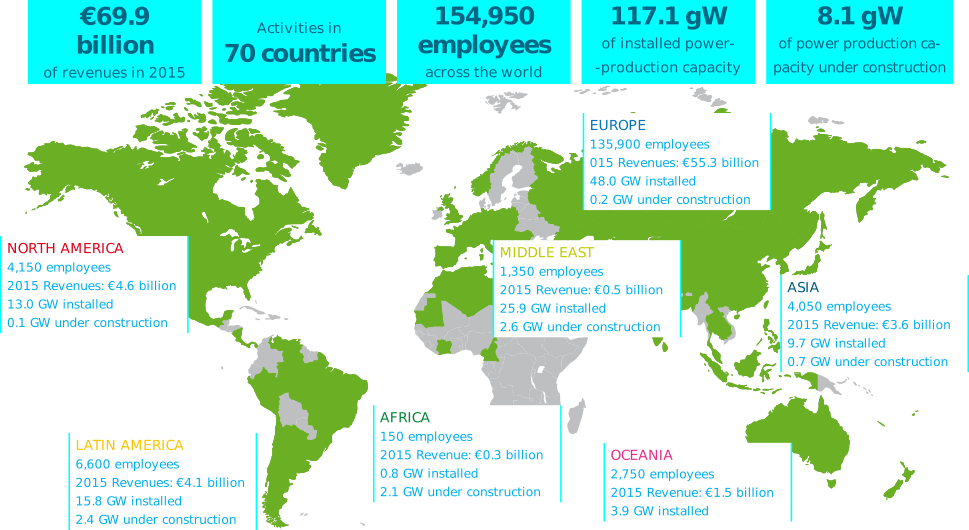

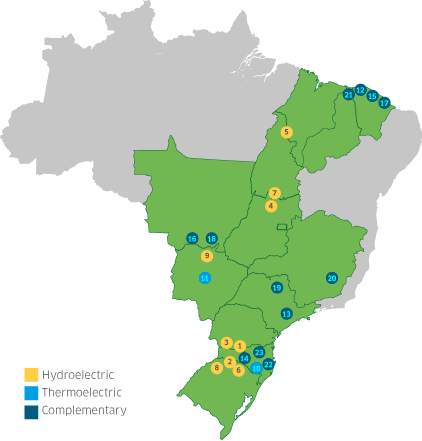

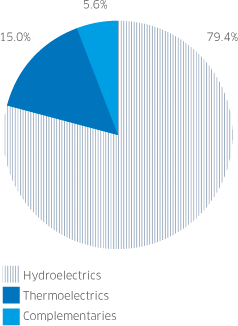

With registered offices in the city of Florianópolis (SC), ENGIE Brasil Energia operates in the generation as well as the commercialization of electric energy. In the generation segment, it installs and operates plants fired from conventional energy sources such as hydroelectric, thermoelectric and complementary units — small hydroelectric plants and wind, biomass and photovoltaic plants. In 2016, the Company also made its debut in the distributed generation segment. In the commercialization area, ENGIE Brasil Energia buys and sells conventional and incentivized energy, its clients being located throughout the country. GRI G4-3; G4-4; G4-5

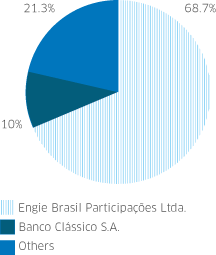

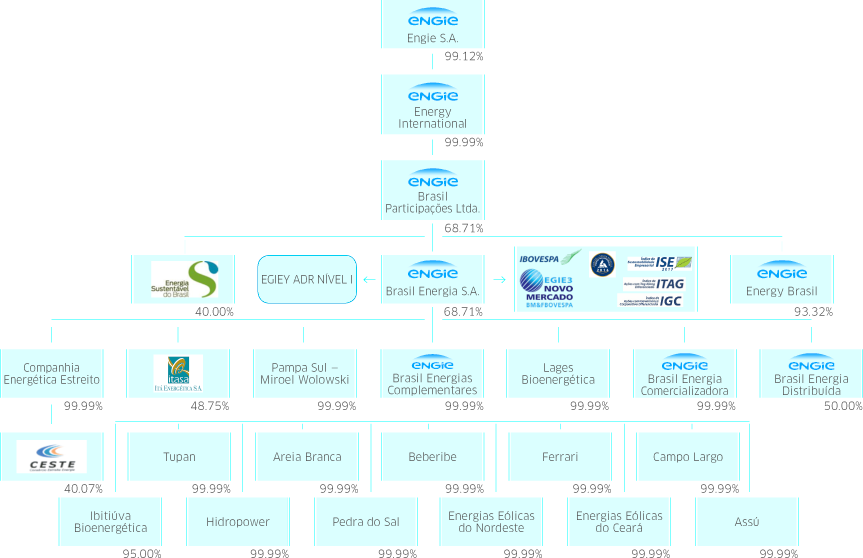

At the end of 2016, ENGIE Brasil Energia’s capital stock stood at R$ 2,829.1 million with a total of 652,742,192 common shares trading regularly on the BM&FBovespa - Securities, Commodities and Futures Exchange. The Company also trades Level 1 American Depositary Receipts (ADRs) in the American over-the-counter market under the EGIEY symbol with a ratio of one ADR for each common share.

8.720,0 MW

is the installed capacity operated by ENGIE Brasil Energia.