Nexes of Trust

Competitive Differentials

Exclusive Brands

A fundamental element of identity, exclusive brands predicate the assurance and exclusivity of GPA and, thus, prove to be an important competitive edge, reinforcing the Company’s image and increasing the profitability of retail food sales, in addition to building loyalty among customers of the Extra and Pão de Açúcar chains.

The performance in 2013 reinforced this positioning: the relative participation of exclusive brands increased 200 basis points, to 8% of Multivarejo sales. Among the factors that contributed to this historic performance, the following stand out:

> Relaunch of the Taeq brand, with innovation in products, aligning presentation with the positioning of being a healthy brand, relaunching the brand concept (from "life in balance" to "take charge of your life," as more in line with consumer tendencies), and new packaging.

> Strengthened processes in the Casino brand, with work in partnership and detailed management of the portfolio, inventory, pricing and communication of the gourmet positioning of the brand. As a result, the products recorded double-digit sales growth during the year, with economies of scale.

> Launch of the Finlandek brand, focused on bed, bath and kitchen products, which exceeded the sales targets for 2013.

> Build-out of the smart choice positioning (chasing the brand leader, with lower prices) for the Qualitá brand, with more than 100 innovations and relaunches, in addition to a new communications campaign focused on the cost-benefit analysis and a new promotional campaign called "Great Offers."

> Expanded portfolio of the Club des Sommeliers brand of wines, with the inclusion of lighter and more affordable products, in addition to items with greater value added, which contribute to strengthening its positioning as the biggest brand of wines of Brazil (by nationality and number of labels).

Logistical Efficiency

With capacity to support the Group’s growth and handle foreseeable demand throughout the supply chain, and suit the product mix to each cluster and business, logistics are a fundamental part of GPA’s operations.

Over the course of the year, actions were taken to capture logistical synergies among the businesses, such as beginning to share distribution centers for bricks-and-mortar stores and e-commerce, ensuring increased productivity and reduced operating costs, and contributing to financing the level of competitiveness in pricing.

Highlights included the Minimercado Extra’s initiatives to strengthen the concept of the advanced logistics unit, which funnels store supply through a hypermarket acting as a focal point for distributing merchandise. This strategy afforded more efficiency and agility, with lower costs in supplying the units.

At Nova Pontocom and Via Varejo, the challenge was integration, in pursuing logistical and operating synergies. Toward this end, one distribution center was inaugurated in Camaçari (BA), and another was built in Contagem (MG), with inauguration anticipated for 2014, both being shared by the two businesses. Nova Pontocom also consolidated three distribution centers into one in São Paulo, with the objective of improving the level of customer service, reducing delivery times and increasing operating efficiency.

FIC

For the very characteristics of the business, with two sizable partners (GPA and Itaú Unibanco) that contribute technology and expertise in their respective areas of activity (retail and financial services), FIC is another important distinguishing feature of the Group, with the capacity to attract and retain customers, and significant potential for growth going forward.

In 2013, FIC continued working to enhance efficiency in its product lines, maintain suitable control of arrearages, with better discrimination and concession of credit.

This positioning contributed to the results for the year, which beat the performance in 2012, reinforced by maintaining the revenues and controlling the expenses of the operation.

In joint effort with GPA’s Marketing department, FIC developed a series of initiatives to offer ever more tangible benefits that customers notice. Among these, the following stand out:

Rebuild of the FIC sales force at Pontofrio – the sales force was completely overhauled, involving the hiring of 1,200 people from August through November, representing an increase of 300% in the number of employees. Robust results were achieved in 2013: 100% coverage of the stores, and an increase in the penetration of FIC cards in Pontofrio sales, from 9% to 13%.

New benefits for Extra cards – At Multivarejo, the highlight was the implementation of new offers through Extra cards, sustained by offering customers more discounts and benefits. Marketing actions were undertaken to build the visibility of the benefits offered, and encourage customer use of the cards (on Extra Wednesdays, cardholders get a 12% discount on fruits, legumes and vegetables). In addition, the number of products with a discount for card purchases increased from 50 to 400 during the year.

Remodeling of the Pão de Açúcar card – The remodeling of the Pão de Açúcar card was approved during the year, to transform it into a more attractive product, with a series of benefits for customers, with implementation slated for the second half of 2014.

Building on this performance, FIC began 2014 with notable distinguishing benefits, and maintains strict control of defaults and costs, with positive expectations for sales growth over 2013, both in Retail Food and at Pontofrio.

Corporate Reputation <4.16>

In 2013, GPA’s Corporate Communications department was formed to build and strengthen the reputation of the Group and its businesses among the various stakeholders.

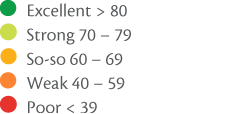

Managing intangible assets falls within the scope of this positioning. Internal and external surveys track these assets, highlighted by a diagnostic survey conducted by the Reputation Institute, which noted the principal drivers of GPA’s reputation amongst its stakeholders: customers, employees, investors, the press and suppliers. The grading of the company’s reputation is strong among all the stakeholders surveyed, as is shown below: