Corporate governance

IR Global Rankings recognizes ALL as one of the five best companies in communication with investors worldwide.

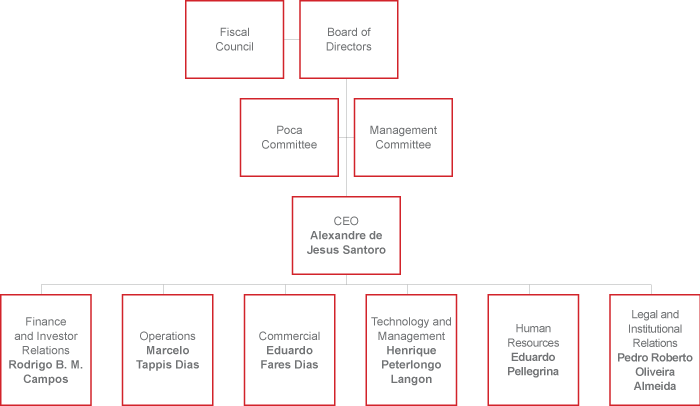

Governance structure

America Latina Logística is a public company listed on the BM&FBovespa stock exchange. Since 2010, it has been listed on the Novo Mercado, comprising companies with the highest standards of corporate governance, which translate into more rights and more detailed information for shareholders.

The Board of Directors is the highest governance body. It comprises 15 members, of whom three are independent, in accordance with the listing requirements for the BM&FBovespa Novo Mercado. These are elected in the Annual General Meeting for a mandate of up to two years. Their main responsibilities include appointing and removing directors, establishing business guidelines for the company; and implementing the company’s economic, social and environmental policies.

The board normally meets every two months and on an extraordinary basis when convened by the chairman of the board, who is also elected by the General Meeting for a two-year mandate and may not hold an administrative position in the company.

Two committees are subordinated to the board and support members in decision making in specific areas:

- Management: this is a non-executive body which does not have a maximum or minimum number of members. It comprises individuals indicated by the Board of Directors. Its function is to make recommendations to the board regarding budgets, targets, variable remuneration, investments and large contracts.

- Stock Option Plan (Poca): comprising all members of the Board of Directors, this committee is responsible for managing the share purchase option plan (Poca). Both committees meet only when convened by the chairman of the Board of Directors.

Executive decisions are the responsibility of the Board of Executive Officers, consisting of seven directors (including the CEO) elected by the Board of Directors for a mandate of up to two years. They operate as a collegiate committee, meeting every 15 days. Their main attributions are to define the standards and regulations to ensure the proper functioning of company services, to assess the company’s results and prepare and submit for the approval of the Board of Directors the annual and pluriannual budgets, expansion and modernization projects and investment plans.

The governance structure also includes the Fiscal Council, a permanent body comprising three to five members elected by the AGM for a mandate of up to one year. This meets on a quarterly basis and its main attributions are to oversee management performance and to analyze the company’s financial statements, reporting on these to the shareholders.

Shareholders participate in decision making through the Annual General Meeting, which is normally held during the first four months of the year for the purposes provided for by law, and extraordinarily whenever necessary and whenever convened by the Board of Directors .

Each ordinary share of the company entitles the holder to one vote as established in best market practice. The meeting is also the channel via which shareholders make recommendations to the Board of Directors.

Our vision

To be the best logistics company in Latin America.

Our values

- Customer focus

- People make a difference and are worth what they do

- Integrity and transparency

- Profit to grow the company's value continuously

- Simplicity with creativity and austerity

- Methodology and quality to drive continuous improvement

- Delight in working as a team, in safety

- Responsibility towards the community and the environment

- Vision of business owner

| ALL Group Ownership structure (on March 31st, 2014) | |

|---|---|

| Free-float | 62.83% |

| BNDES Participações S.A. (BNDESPAR) | 12.10% |

| Julia Dora Antonia Koranyi Arduini | 5.61% |

| Global Markets Investments Limited Partnership (GMI) | 4.94% |

| Fundo de Investimento em Participações (BRZ ALL) | 4.79% |

| Caixa de Previdência dos Funcionários do Banco do Brasil (Previ) | 3.95% |

| Fundação dos Economiários Federais (Funcef) | 3.88% |

| Riccardo Arduini | 0.78% |

| Treasury | 0.83% |

| Administration | 0.28% |

| Total | 100% |

Risk management

ALL monitors diverse categories of risk, including operations, shareholders, suppliers, customers and regulatory bodies. Six are particularly worth of note:

- Interest risk in Brazil: as a large part of the company’s debt is subject to floating interest rates, ALL pays close attention to variations in rates and uses swap instruments to protect its assets.

- Crop risk: the company monitors the planting and harvest of the agricultural products it transports in Brazil on a regular basis with a view to adapting operating plans to variations in this market.

- Risk of legal suits or administrative processes: the legal team and outsourced counsels track all lawsuits which may affect ALL.

- Operational risk: the company monitors the risk of accidents with hazardous cargoes, acts of vandalism against trains and cargoes and the transportation of outsized equipment. The company’s operational and environmental risk management programs comprehend risk analysis and management and the development of emergency response plans.

- Regulatory risks: these include possible changes in the laws, rules and regulations governing rail services which could directly affect the company. ALL tracks these changes by maintaining a close relationship with the regulatory body ANTT (Agência Nacional de Transportes Terrestres) to ensure it is prepared to make any necessary adjustments as rapidly as possible.

- Environmental risks: the company monitors environmental impacts caused by its activities on a periodic basis. In the event of the occurrence of accidents that generate liabilities, ALL assumes responsibility for remediation and ongoing monitoring of the area affected. To improve preventive measures, the company is reformulating its Emergency Response Plan and Risk Management Program. In an unprecedented initiative, the methodology for these programs was developed in conjunction with the environmental authority Ibama.

Transparency and communication

The ALL Code of Ethics sets forth the guidelines to engender responsible, transparent conduct and mutual respect among employees and company stakeholders. The document is disseminated in conjunction with a term of responsibility and declaration of acceptance which each employee signs after participating in a specific training program. The ethical principles are reviewed on an annual basis and define how employees should relate to the company's diverse stakeholders, such as shareholders, investors, government and regulatory bodies, customers and suppliers. The code also provides guidance on conflicts of interest and information security.

The content, which is available on the website www.all-logistica.com.br and on the company’s intranet, is also disseminated in internal communications, in monthly events and in departmental meetings. ALL also uses its Facebook page to publicize relevant information.

The Ethics Committee oversees the application of the code and analyzes any reports of violations made by employees to the ALL Ombudsman, a service available by telephone (0800-701-2265) and by the email [email protected]. The committee is composed of representatives from the Ombudsman service and the Legal, Labor Relations and Human Resources areas.

In addition to the Ombudsman service, other internal mechanisms are applied to combat fraud and corruption. These include the Fiscal Council, which has the powers of an audit committee. ALL also invests in tools to ensure the transparency of its business. PricewaterhouseCoopers (PwC) are the independent auditors responsible for auditing the company’s financial statements. They also monitor internal controls, compliance with internal rules and procedures and the IT environment, in order to ensure the integrity of the information input into the company's systems. The auditors’ activities are in accordance with Brazilian and international accounting standards and best practices related to internal controls.

Although they work in a horizontal management structure which facilitates easy and frequent access to leaders, ALL employees also have formal channels through which they may question or make recommendations to the company. There are quarterly meetings involving all managers, superintendents and directors in which the projects in progress, the results of the entire company and the performance of the different areas are presented. Additionally, the Ombudsman area, accessible to all employees, has a deadline of seven working days to respond to each contact.

Market relations

Recognition of ALL in the IR Global Rankings as one of the five best companies in communication with investors in 2013 is an indication of the efforts the company makes to maintain close relations this stakeholder group. One of the main international rankings in the investment community, IR Global Rankings elected ALL after assessing more than 300 companies on five continents, based on a methodology supported by global institutions such as Arnold & Porter, KPMG and Sodali. ALL received recognition in the categories Financial Disclosure Procedures and Online Annual Report.

In its Investor Relations portal (http://ri.all-logistica.com), the company discloses financial information and offers shareholders services such as an investment simulator and the automatic dispatch of emails whenever new information is published. The company’s quarterly earnings are made available via presentation, webcast, transcription (text file) and podcast (audio file). In 2012, ALL was the first Brazilian company to launch an IR application for iPad, iPhone and Android. The application may be downloaded free of charge from the company’s portal.

Management model

ALL’s strategic planning follows five-year cycles, with annual execution plans and monitoring, aligned with the company budget. Planning is reviewed every two years by key leaders in accordance with the results achieved and the company’s long-term vision. Should an extraordinary event occur that affects company strategy, this review is brought forward. Currently ALL is focused on obtaining productivity gains on assets with a controlled level of investment.

The Board of Directors meets annually to determine the growth the company should achieve in its main indicators (volume, EBITDA, net profit and cash flow) during the next year. During the budget process, these indicators are broken down into operational, financial and safety targets for all employees. Performance towards these indicators is monitored continually, and the results are communicated to the market on a quarterly basis.

Employee performance appraisal is conducted by means of the Internal Management System and is applied to all levels, with the exception of the Board of Directors. This is a performance appraisal and measurement program based on two major pillars: Management by Objectives and Management by Routine. The former is aimed at sustaining company growth and motivating employees through a system of targets and performance appraisal. The objective of the latter is to incorporate continuous improvements into the work place and company infrastructure. (read more on Employees).

Compliance

When it received the concession, ALL inherited labor suits brought by employees of the extinct Rede Ferroviária Federal (Federal Rail Network). In 2013 this, together with the company's extensive employee base (approximately 8,500 people), led to ALL's condemnation in 945 labor suits and the receipt of 67 fines in administrative processes, totaling R$ 57 million and R$ 300,000, respectively, in addition to some monetary sanctions. However, the company has been working on improving working conditions for the people working in its operations. In 2013, ALL created a cargo origination system to avoid queues of trucks in the TAG and TOM terminals and to reduce waiting times in unloading processes for the truck drivers supplying the terminals. The company has also focused on continually upgrading the Santos export corridor and the rail network as a whole, improving the working environment for employees.

For 2014, ALL has a target of reducing labor liabilities by R$ 80 million and the number of labor suits by 3 thousand. It also intends to increase the number of disabled people it hires to comply with Conduct Adjustment Agreements (TACs), court orders and labor agreements and to maintain ongoing negotiations with the Labor Public Prosecution Department. In the regulatory area, the company received 14 fines and 15 non-monetary sanctions (warnings) in 2013. The most relevant case was a fine of R$ 560,000 involving the Ijuí warehouse in Rio Grande do Sul. In the civil area, the company paid a total of R$ 500,000 in fines in 2013.

ALL and Rumo: proposed merger

On February 24th, 2014, ALL received a proposal from Rumo Logística Operadora Multimodal S.A. to combine the two companies' activities through the incorporation of ALL stock by Rumo. The proposal values ALL at approximately R$ 7 billion (R$ 10.18/share) and Rumo at R$ 4 billion. Under the proposal, ALL shareholders will have a 63.5% stake in the new company, while Rumo shareholders will have 36.5%.

The proposal was put first to the ALL Board of Directors and approved on April 15th, 2014. On May 8th, 2014, the shareholders of both companies approved the merger in their respective Annual General Meetings.

The merger is still subject to the approval of the Brazilian antitrust authority Cade (Conselho Administrativo de Defesa Econômica) and the national ground transport agency ANTT (Agência Nacional de Transportes Terrestres). The merger between ALL and Rumo, which is currently a customer of the company, will result in important synergies for the new company. As a single operation, there will be greater integration in transportation and unloading processes, since Rumo has terminals in the Port of Santos, the main port served by ALL. The merger will also permit greater flexibility in the use and allocation of assets among the different products transported.

The members of the Board of Directors of the new company will be elected on the date that the incorporation is consummated. The board will comprise up to 17 members, with up to six nominated by the signatories of the ALL shareholders' agreement, one by TPG, one by Gávea and nine by Cosan. To be considered independent, the members nominated by Funcef, Previ and BRZ will need to meet the requirements stipulated for the Novo Mercado, the highest level of corporate governance on the BM&FBovespa.

Information available about this subject at (www.all-logistica.com/ri).