Stakeholder Relations

Clients

In our relationship with our clients, we strive to excel in service, offer them the appropriate products and services, and deliver outstanding performance in investment management. We want to provide the best solution to boost client satisfaction and help our clients achieve their life plans.

To improve our sales and satisfy our client base, we provide our clients with educational and objective information on the features of retirement plans by using different outreach channels. In addition, we are constantly training our sales professionals (both consultants and Banco do Brasil account managers) and preparing them to play a role in the consultative sales process with a focus on the solution that best suits the needs of each client profile.

In 2013, we trained over 14,000 Banco do Brasil employees in 954 meetings, an 86% increase over 2012.

During this period, we had sponsorships in industry publications, such as Você S/A's special retirement issue, and initiatives that focus on financial literacy – from radio spots to new YouTube videos (the Brasilprev Explica or Brasilprev Explains series). We created Retirement Demystified, a microsite that answers the most frequently asked questions regarding retirement plans. To explain changes in the economy and the volatility of investment funds, we conducted road shows on this issue for Banco do Brasil clients and managers and we also produced a public video.

Communication Channels

With a wide range of communication channels for our clients, over the last few years, we have been getting positive feedback in satisfaction surveys. The key services, tools, and perks we offer our clients are as follows:

Call Center

In 2013, our call center was recertified to ISO 9001:2008 and Probare in the Code of Ethics and Management Maturity categories, a testament to the quality of our services and our concern for keeping a trained call center team. Among other aspects, this also led to positive results in the post-call satisfaction surveys, with an average score of 9.4 (on a scale of 0 to 10), the same grade from 2012. During this period, we received over 796,000 calls, a 6.2% increase over 2012. This increase was caused by the growing number of clients looking for more information on the yield of our retirement plans.

Mobile Banking

The smartphone application for Banco do Brasil account holders allows our clients to check their Brasilprev retirement plans and get statements, receive yield information, do simulations, make additional contributions, among other services. In 2013, we recorded over 867,000 transactions via mobile banking, a 167% increase over 2012.

Ombudsman

Transparency, independence, autonomy, and impartiality are the basis for this department's efforts when hearing from and speaking to our clients. The ombudsman office's main mission is to find solutions for different complaints and demands, which usually have been escalated, to ensure the rights and duties of both parties in the contractual relationship. In 2013, our ombudsman office was recertified to ISO 9001:2008, which ensures the excellence of our quality standards.

Website

Our user-friendly interactive portal (www.brasilprev.com.br) is continuously updated and improved and received 1.3 million hits in 2013, a 15.6% increase over 2012. The restricted and secure area, which is shared with Banco do Brasil (this can be accessed with the same branch code, checking account number, and password), where our clients can check up-to-date information, such as balance, financial statements, wage and tax statements, among other data, had 304,000 hits. In addition to an educational website on the retirement plans we offer, our portal also contain a retirement plan simulation tool (to plan investments) as well as an income tax guide.

Short Message Service (SMS)

We ended 2013 with the Banco do Brasil SMS Project and improved the cell phone messaging service for our clients, a practical way of showing we care about client service.

To cut costs, this service will become even more stable. In the future, we intend to increase the number of text messages sent to our clients and change the type of outgoing messages, which currently pertain to the plan's balance, to withdrawal monitoring, the status of pending documents, and barcodes for making contributions.

Banco do Brasil Self-Service Terminals

Banco do Brasil clients can get a statement of their Brasilprev retirement plans from the more than 44,000 self-service terminals available. In 2013, over 277,000 tickets were processed.

Client Relationship Program

To keep our clients closer, we have developed a client relationship program with a number of meetups (breakfasts, dinners, sponsored concerts, exhibits, and cultural performances). Throughout 2013, we held more than 134 events, which were attended by nearly 43,800 clients and prospects. The following are some other activities we carried out during 2013.

Brasilprev Explica

Our corporate YouTube channel got four new Brasilprev Explica (Brasilprev Explains, in Portuguese) episodes. Each episode lasts three to six minutes and is presented by a financial consultant. With a plain language, the videos use a Q&A format to answer the questions of a fictitious viewer to explain how retirement plans work without resorting to technical terms. Plus, images are used to make it easier for viewers to understand financial calculations. With these releases, there are now 16 videos, divided by topics such as services, products, and financial literacy.

In 2013, changes in the current state of affairs also led to the production of a special video about the economic volatility during this period and the retirement industry trends. We wanted to let our clients know what was going on and reinforce the main feature of our retirement plans: long-term investment.

Retirement Primer

Another initiative that also reinforces our concern for spreading values and concepts that are tied to long-term savings was the release of Previdência sem mistério (Retirement Demystified, in Portuguese). Using an educational, direct, and informational language, this primer (divided into five chapters) explains what retirement plans are and how they work, the options and pros of the investments available in the Brazilian marketplace, what you have to look for when getting a retirement plan, and so forth. Digital contents are available on our home page.

Road Shows

In association with Principal International and BB DTVM, we gave lectures on the Economic Prospects in Brazil and the World to clients from the Wholesale and Upscale segments and Banco do Brasil managers. We wanted to assess the behavior of financial markets within a context of change with rising uncertainty about the direction of the economy.

During two weeks in August, we held 11 meetings in nine cities of different Brazilian regions and reached 822 people. These lectures were given by our Chief Economist, Edgard de Abreu Cardoso, BB DTVM's Marcelo Gusmão Arnosti, and Principal International's Valentín Carril Muñoz, who is in charge of the asset allocation strategy for Latin America. This initiative was also followed by a video, which was presented by one of our experts, to explain the impact of the economic scenario on retirement funds, which are, by definition, devoted to long-term savings.

Corporate Clients

We offer businesses an effective tool to attract and retain talents in their staffs and we meet their needs with a highly-qualified team of consultants, who specialize in the corporate segment and help them through the entire process, from modeling and deploying retirement plans to managing benefits, in support of Personnel Management departments. We organize workshops and use internal hotlines to answer frequently asked questions from teams about the main features of retirement plans, reinforcing the concept of long-term savings and the benefits of financial planning.

Our corporate clients can also use our financial-literacy initiatives, such as the My Life Plan platform, which contains an online course on budget planning, interest rates, expenses, among other related issues. For people that are approaching the retirement age and are close to fulfilling their life plans, we completed a financial-literacy workshop in 2013. This initiative addresses issues such as retirement education, changes in finances, how to set aside and protect your reserves, among others. This presentation will now be offered to our corporate clients in 2014. Faced with a growing number of corporate retirement plans in Brazil, we took action: we developed an exclusive microsite (available on our Intranet as well) to help employees that left their job, but want to continue to be plan beneficiaries.

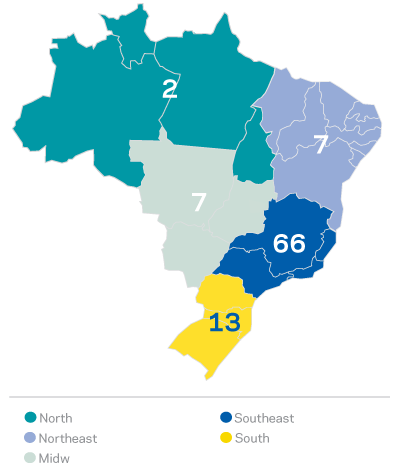

NUMBER Of BUSINESS CONSULTANTS BY BRAZILIAN REGION

Tell a friend

Tell a friend