Corporate Governance

In the first company he worked for, Mr. Mendes da Silva asked the board to offer corporate retirement plans to all employees. Thus, he felt encouraged to start his long-term savings. In turn, Mrs. Amorim, claims she didn't think about the importance of financial literacy for years, but that changed when she started working. Currently, she worries about spending consciously and saving to achieve her plans. For both, retirement plans encourage the discipline to save and contribute to long-term financial planning.

Our actions are in line with the best industry practices and the precepts that are upheld by the Brazilian Institute of Corporate Governance (IBGC, acronyms in Portuguese). Our managers prioritize ethics, respect, and fairness in our relations with our stakeholders, corporate responsibility when doing business, as well as transparency, reliability, and accountability. We are constantly trying to improve our governance and our structure has been undergoing several changes that will enable us to lead a new cycle of sustainable growth.

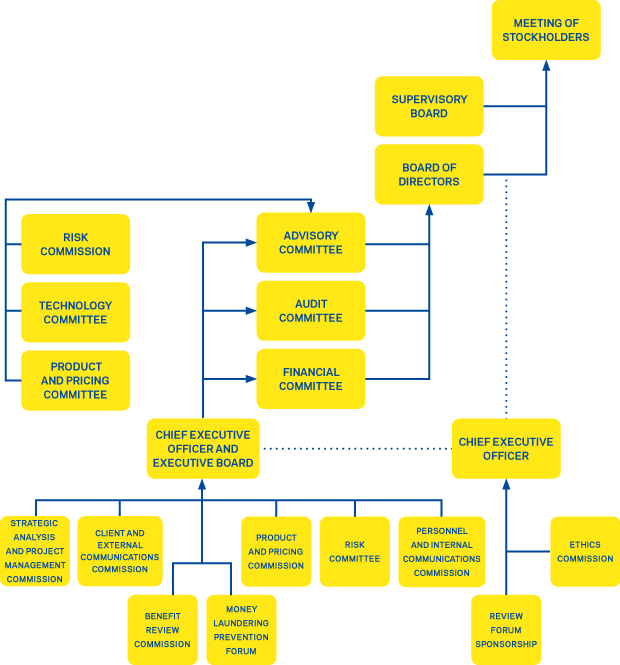

Our governance structure is composed of a set of advisory committees and supporting management commissions to ensure increased agility and assertiveness when making strategic decisions, with a focus on our mission, vision, and corporate values.

In early 2013, we reviewed our governance guidelines, which, in essence, reinforce our longstanding commitment to take action in line with the best practices.

Corporate-Governance

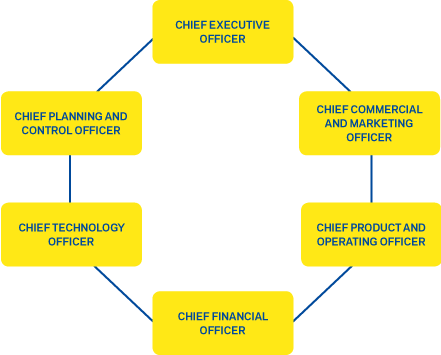

The year saw important changes in our executive board. In February, Miguel Cícero Terra Lima, our former Chief Commercial and Marketing Officer since 2009, became our Chief Executive Officer, with another stint at the company in his capacity as Sales Executive from 2001 to 2003. He also took the helm temporarily, from May to September 2012.

At the end of August, Oton Cabral Gonçales became our Chief Commercial and Marketing Officer.

Meeting of Stockholders

As our chief deliberative body, the meeting of stockholders is composed of a representative from each shareholder, who come together once a year or on an as-needed basis on special occasions. Its main roles are to examine, discuss, and vote on financial statements and deliberate on how net earnings and dividends should be apportioned. In addition, it elects Supervisory Board members and approves the capital stock's inflation adjustment.

Boards

Supervisory Board

Our Supervisory Board, a permanent institution with one-year terms, convenes every three months and is composed of four supervisors and four substitutes. They are appointed by our shareholders. They are tasked with investigating the actions and finances of managers as well as reviewing hot-button issues, which are to be discussed during the meetings of shareholders.

Board of Directors

As our top management organization, with no operational or executive attributes, our board of directors is tasked with the general direction of our businesses by following up on our performance indicators and drafting, analyzing, and approving corporate strategies, business policies, and decisions with a focus on quality and security.

Our board of directors is composed of eight directors and eight substitutes, including a chairman with no executive duties at the company, with three-year terms (they can be reelected). The board convenes every three months or on an as-needed basis, when summoned. Because it favors a dynamic interaction with the executive board, it streamlines the decision-making process to better meet the expectations of our shareholders.

Committees

Financial Committee

Created to advise our board of directors, it is tasked with preparing policy proposals and general investment guidelines, among others. It has five members (our Chief Executive Officer, two shareholder-appointed members, our Chief Financial Officer, as well as our Chief Planning and Control Officer), with two-year terms (they can be reelected), who convene every month to review the performance of our investment portfolios, assess our Risk Management efforts, and prepare new investment policies, which will later be submitted to our board for approval.

Audit Committee

This permanent committee, approved by the Brazilian Federal Board of Insurance (CNSP, acronyms in Portuguese) Resolution No. 118 / 2004, is composed of three members with one-year terms (renewable for up to five years). They are elected by our Board of Directors. Two of them are appointed by our shareholders and one is elected by mutual agreement. In addition to their legal responsibilities, the members of the Audit Committee are tasked with advising our Board of Directors on improving our internal controls, assessing our financial reports, and monitoring the performance of our internal and independent audits. On our website, this committee also has a direct hotline to all our stakeholders.

Advisory Committee

The Advisory Committee was created to investigate and review corporate issues and advise our Board of Directors. It is composed of our Chief Executive Officer and two shareholder-appointed members, who are elected from the members of our Board of Directors. Their terms on the Executive Board and the Board of Directors run concurrently.

The Advisory Committee relies on three subordinate committees:

- Risk Committee

The Risk Committee is composed of six members – our Chief Executive Officer, our Chief Financial Officer, our Chief Product and Operating Officer, our Chief Planning and Control Officer, and two other shareholder-appointed members – with three-year terms. This committee is tasked with assessing and monitoring our market, credit, liquidity, and systemic risks in issues that pertain to our risk management policies and guidelines.

- Technology Committee

The Technology Committee is composed of four members (our Chief Executive Officer, our Chief Technology Officer, and two shareholder-appointed members) with three-year terms and helps the Advisory Committee with our information technology management efforts.

- Product and Pricing Committee

The Product and Pricing Committee is composed of seven members – our Chief Executive Officer, our Chief Financial Officer, our Chief Product and Operating Officer, our Chief Planning and Control Officer, our Chief Commercial and Marketing Officer, and two other shareholder-appointed members – with three-year terms and supports the Advisory Committee with regard to our general product and pricing policies and guidelines.

Executive Board

Our Executive Board is tasked with managing our company strategically in line with the guidelines from our Board of Directors. It is composed of six members – our Chief Executive Officer, our Chief Commercial and Marketing Officer, our Chief Financial Officer, our Chief Technology Officer, our Chief Planning and Control Officer, and our Chief Product and Operating Officer – with three-year terms and supports the following commissions in their decision-making processes:

Commissions

Strategic Analysis and Project Management Commission (CAEP)

It is composed of six members (one superintendent for each executive department) with one-year terms. They convene every month. This commission is tasked with supporting the business decision-making process and defines our project portfolio regarding issues such as strategic goals and objectives, Balanced Scorecard indicators, strategic initiatives, departmental goals, budget, and processes. The Strategic Analysis and Project Management Commission replaced the Project Analysis and Prioritization Commission (CAPP), which, until 2012, was responsible for prioritizing projects at the company.

Client Commission

The Client Commission is composed of ten members: our Upscale Sales Superintendent; our Marketing Superintendent; our Operations Superintendent; our Product Superintendent; our Governance, Internal Controls, Processes and Personnel Superintendent; our Legal Superintendent; our Technical and Actuarial Service Superintendent; our Strategic Management Superintendent; the head of Investment Control; and the head of Market Intelligence. This commission is tasked with assessing and submitting to our Executive Board initiatives that aim to reach sustainable satisfaction, client delight, and improvement levels in corporate or individual client service.

Product and Pricing Commission

The Product and Pricing Commission is an advisory organization that supports our Executive Board in matters pertaining to our general product and pricing policies and guidelines to identify new product opportunities, investment theses and strategies, as well as market trends in Brazil and abroad. This commission is composed of six members.

Risk Commission

The Risk Commission is composed of 11 members and two permanent appointees and advises the Executive Board on issues pertaining to the management and control of our market, liquidity, credit, underwriting, reputational, operational, legal and strategic risks.

Communications Commission

The Communications Commission is composed of ten permanent members: our Marketing Superintendent; our Business and Retail Superintendent; our Wholesale Superintendent; our Upscale Superintendent; our Strategic Management Superintendent; our Digital Channel Manager; our Call Center Manager; the head of Corporate Communications and Social Responsibility; the head of Communications – Marketing, and the head of Market Intelligence. This commission aims to assess and submit to our Executive Board proposals on issues pertaining to advertising and promotional campaigns as well as project sponsorship efforts. It is also tasked with monitoring the exposure of the Brasilprev brand in the Brazilian retirement market.

Ethics Commission

The Ethics Commission must propose the appropriate actions and means to publicize and enforce the Brasilprev Code of Conduct, assess potential misconducts, suggest the appropriate disciplinary action, and manager our Ethics Hotline, which is available on our corporate Intranet and on the Internet.

FoRums

Benefit Review Commission

This commission is composed of five members and five substitutes, who are in charge of reassessing and / or reviewing the denial and / or granting of death / disability retirement benefits.

Money Laundering Prevention Forum

This deliberative body deals with the communications with the Brazilian Financial Crimes Enforcement Network (COAF, acronyms in Portuguese) concerning cases that are subject to Article 13, Group 2, item II of the Brazilian Federal Department of Insurance (SUSEP, acronyms in Portuguese) Resolution No. 445/2012. This document addresses the prevention and fight against money laundering-related offenses. This organization is composed of four permanent members: the head of Accounting, the head of Retail and other channels, the head of Benefit Changes and Rollovers, and the head of Internal Controls and Compliance.

Sponsorship Forum

This organization assesses initiatives and recommends sponsorship project proposals to our Chief Executive Officer. In addition, it defines how to carry out the projects that were approved and follows up on their results. It is composed of five members: the head of Digital Channels, our Call Center Manager, the head of Corporate Communications and Social Responsibility, the head of Communications, and the head of Client Intelligence and Management.

Our governance also relies on the support from the following bodies and policies:

Audit Committee Channel

This tool is available to all audiences on our website. This channel is devoted to Audit Committee inspection issues. All messages are confidential. When needed and if appropriate, the information is directly forwarded to our Board of Directors for analysis and resolution purposes.

Ethics Hotline

This hotline, whose unrestricted communications are fully integrated with the company, can be accessed via our portal online. All communications are completely confidential. The Ethics Hotline gathers complaints about questionable business practices and fraudulent or unethical behaviors among employees, clients, suppliers, and other partners. Any and all communications are forwarded to the Ethics Commission, which will then review the information and take appropriate action.

Code of Conduct

Our code of conduct contains instructions, rules, and guidelines on the social behavior of our employees. In line with our corporate culture, it approaches topics related to ethics, personal responsibility, professional secrecy, conflicts of interest, among other major aspects that must be watched inside and outside the work environment. To adopt guidelines that encourage professional relationships based on ethical principles, with loyalty, justice, transparency, and trust between stakeholders, all managers and employees receive a copy of the document, which is also available on our Intranet and our governance portal on the Internet.

Internal Controls, Compliance and Fraud

Throughout 2013, we paid attention to our industry's legal requirements and committed to improving our operations to secure and streamline our internal management processes and controls.

Because of the nature of our business, the increase in assets under management also requires the constant improvement of monitoring processes. Since 2012, we have been using a team devoted to preventing and fighting fraud (Internal Controls and Compliance), who aims to map critical processes, identify potential control deficiencies, suggest improvements, and organize training sessions with cultural efforts to change the habits of employees from different teams.

One of the highlights of the year was the Money Laundering Prevention Guide initiative, an internal effort carried out by Compliance and Processes agents. We want to keep our employees aware of this issue, which has been increasingly discussed in the financial industry, and prevent our company from getting involved in this type of offense. The publication, a practical guide, describes money laundering, how and where it occurs more frequently, the laws and basic principles for prevention, among other steps to fight this illegal practice.

The material is now also the starter kit for new employees, who must also attend courses on our Code of Conduct, Prevention and Fraud, Information Security and Money Laundering Prevention, and Counter-Terrorist Financing, the latter of which follows the guidelines stated in the Brazilian Federal Department of Insurance (SUSEP, acronyms in Portuguese) Rule No. 445 / 2012.

The anticorruption issue was also a hot-button issue during 2013, with the creation of an internal rule that established procedures to be deployed to prevent and detect potential involvement in corruption. This issue was addressed during training sessions with Compliance and Processes agents and our providers. A Compliance professional specializing in anticorruption made a presentation to all of our managers.

During an October lecture, employees were also encouraged to rethink how they behave in social networks. The event allowed us to think about the need to be vigilant about the information we share in these channels, which may expose our personal and professional lives.

Additionally, a new edition of the Information Security campaign was held to make employees aware of the importance of paying attention to this issue both at work and at home. The key message was that everybody needs to protect the information they produce or access on paper, by e-mail, in computer files, or even social networks on the Internet. This initiative is part of the training on these procedures and has already been incorporated into our mandatory activities.

Ombudsman

To tailor our efforts to everyone's needs, our Ombudsman Office utilizes three outstanding hotlines: Internal Ombudsman Office, External Ombudsman Office, and Supplier Ombudsman Office, whose contacts are listed on our website. They are independent channels that report directly to our Chief Executive Officer and are supposed to act as a direct line to our senior managers in compliance with the principles of impartiality and confidentiality. Thus, it ensures rights and guides duties in contractual relationships.

Our current Ombudsman team is composed of seven experts that were certified by the Brazilian Ombudsman Association (ABO, acronyms in Portuguese) and follow the principles of the International Ombudsman Association (IOA).

Our Ombudsman Office renewed its ISO 9001:2008 certification and has been recertified until 2014, with accreditation in Brazil and abroad, respectively, from the Brazilian Institute of Standards and Technology (CGCRE / INMETRO, acronyms in Portuguese) and the ANSI-ASQ National Accreditation Board (ANAB). This certification ensures quality excellence in our three service channels.

Tell a friend

Tell a friend